Home > Thailand Property Buying Guide

A complete guide to Thailand’s land and housing tax system. Come and see how much tax you have to pay for your Thai property!

When purchasing real estate, whether for investment or personal use, you must carefully calculate the relevant taxes. If the real estate tax is too high, it may erode the investment profits. If you invest in Thai real estate through leasing, you will need to consider the relevant taxes on the rental income. Now let’s take a look at Thailand’s real estate tax system! There are many details to consider before you buy a condo:

- An open and transparent tax system, no real estate holding tax

In addition to the excellent appreciation potential and rental return rate of Thai real estate, another major factor that attracts foreign investors to purchase is the fixed real estate tax system and the lack of other intangible costs. Unlike other neighboring countries, Thailand does not levy an annual holding tax (such as Taiwan's property tax and land tax). Taxes are only required to be paid during buying and selling transactions.

Generally speaking, what are the tax laws related to real estate in Thailand?

- Capital Gains Tax in Thailand

Thailand does not have specific capital gains tax legislation. In practice, capital gains tax is dealt with under the general provisions of the Income Tax Act, which treats capital gains tax as a taxable income subject to personal income tax and corporate income tax. The amount of capital gains taxable on the sale of real estate (or any other asset or investment) is simply the middle of the sales price and the original purchase price. Generally, there is no subsidy if there is inflation (except for shared investments on the Stock Exchange of Thailand). The capital gains tax (income tax) on sales proceeds is the actual amount received, regardless of the market price.

For non-resident taxpayers, capital gains tax income obtained in Thailand is subject to a 15% tax. Foreign non-resident individuals intending to sell property in Thailand should note that they are eligible for a 15% tax exemption under the Double Taxation Treaty.

- Other capital gains tax allowances

The Thai government exempts both resident and non-resident homeowners from taxes when they sell a property in Thailand and then use the proceeds to purchase another property as their primary residence. However, in order to legally obtain tax-exempt status, certain conditions must be met. First, the seller must have previously lived in the property being sold and consider it their primary residence. Secondly, the homeowner must register his or her residential address for at least one year after purchasing the house.

Second: The seller must purchase a new property within one year, either before or after the sale, and the newly purchased property must be used for residence.

The tax amount is calculated based on the current valuation of the property being sold, so it may be higher or lower than the actual sales price. At the same time, the tax amount cannot be higher than the value of the new property.

- Rental income tax

Income from rental properties is taxable under Thailand's income tax law. Tax payable is calculated after deducting expenses incurred from gross income. Depending on the type of rental property, a standard deduction of anywhere from 10% to 30% of rental income is allowed. If actual expenses incurred are higher than the standard deduction amount, the homeowner can claim, but it must be supported by documentation.

Starting from July and August last year (2020), we began to receive a large number of house and land tax bills from property management clients, and the content information and use registration parts needed to be adjusted. So we began a journey of assisting clients with their inquiries with the Land Department. We have compiled the information that everyone wants to know most, this year's "Rules for Housing Tax Reduction and Exemption Rates" and "Housing Tax System for Different Uses" below:

- Property and land tax

Building or property and land taxes are levied annually by the government of the place where the property is located. When individual homeowners rent out their properties, taxes are charged at 12.5% of the annual rent on the lease or the local government's annual assessment, whichever is higher. Properties occupied by the owner are exempt from property and land taxes. At the same time, if the property is rented out or used for commercial purposes, the owner is also responsible for informing the local government and then paying rental tax before the end of February each year.

Generally speaking, in Thailand, taxes are borne by the tenant as stated in the rental contract.

Expenses and taxes associated with selling real estate

The Thai government charges a fixed transaction fee of 2% of the total transaction amount for real estate transactions. In most cases, the buyer and seller will each bear half of the fee (1% each). Both parties are obliged to pay this fee, but depending on the specifications of the contract, the details of the payment amount can be negotiated by the two parties to the transaction. If the property is held for five years or more, an additional stamp duty of 0.5% will be incurred when the property is sold.

The commercial tax on the sale of real estate is 3.3%, which is calculated based on the higher of the actual listing price or the market valuation. This tax includes a special business tax of 3% and a local tax of 0.3%. It is applicable whenever a property is sold for investment profit. It is worth noting that this tax system only applies to transactions made within five years of acquiring real estate ownership. If the real estate is inherited, no matter how many years it is held before the transaction, no additional business tax does not need to be paid.

The withholding tax is calculated by treating the sales amount or the government assessed present value (whichever is higher) as gross revenue, then deducting the expenses listed in Table B (see the attached figure below) to arrive at the net profit. Taxpayers can calculate the annual net income by dividing the net profit by the number of years held, and calculate the amount of income tax payable on the annual net income according to the brackets in Table A. The last step is to multiply the annual income tax payable just calculated by the total number of years of holding to calculate the total amount of withholding income tax.

The original tax standards for the new house and land tax system are:

If registered as self-occupied: the maximum tax rate is 0.3%; if registered as commercial: the maximum tax rate is 1.2%

In order to gradually adapt everyone to paying property tax, the Thai government has set 2020-2022 (estimated) as a transition period, which means that people do not have to pay the full tax in the first two years. The standards are as follows:

- Full tax exemption: If your property is your first property in Thailand and the estimated value is below THB 10 million

- Self-occupied tax: If the property is the second home or the valuation is over 10 million baht, the property tax rate will vary depending on the property valuation rate, as shown in the following table

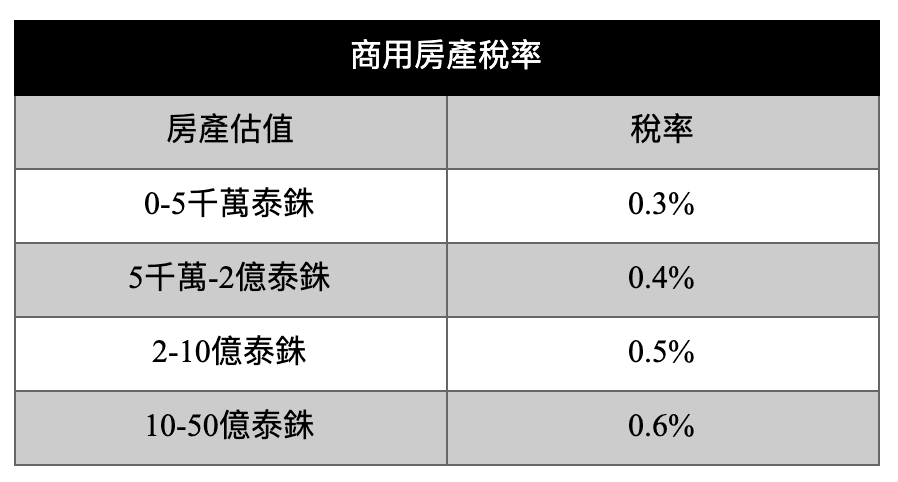

- Commercial tax: If your property is registered as commercial, the property tax rate will be levied in the following manner, as shown in the table below:

Usually for overseas property buyers, the property valuation will fall into the range of 0-50 million baht. At this time, if the property is classified as "commercial" but you actually use it for "self-use", the tax rate will be 15 times different. We have also encountered clients who found that their tax bills were classified incorrectly.

90% tax reduction in 2020-2022 due to the epidemic:

If you do not meet the criteria for property tax exemption, this year the Thai cabinet has decided to help everyone through the difficult times by reducing all property taxes by 90%.

- If you own a self-occupied property in Thailand worth 10 million baht, the tax you would have to pay this year would be 10 million baht x 0.02% (adaptation period tax rate) = 2,000 baht, but this year you can get another 90% reduction.

That is to say, 2,000 baht x 10% = 200 baht. If your property is classified as commercial, the tax rate is 0.3%, and the tax is 30,000 baht. After a 90% reduction, you still have to pay 1,500 baht.

Throne International Real Estate Co., Ltd.

10 countries and 18 locations around the world

Zero time difference, zero distance service

Bangkok Head Office

8, T-One Building, Unit 1, Fl28, Sukhumvit 40, Phra Khanong, Khlong Toei, Bangkok Thailand 10110(T-ONE BUILDING)

Taiwan Company

9F-1, No. 181, Fuxing North Road, Songshan District, Taipei City

Vietnam Company

Tel: 84 90 9996726 / 84 90 9997615

Hong Kong Company

Room 05, 22/F, Leighton Centre, 77 Leighton Road, Causeway Bay

※Investing in foreign real estate is risky. Please read the documents carefully and consider carefully before making any transaction.

※Throne International Real Estate Co., Ltd. (109) New Taipei Brokerage No. 003786

※Registration Certificate No. C0321 of the Immigration Business Association of the Republic of China

© Copyright © 2014-2025 Throne International Real Estate Co., Ltd. reserves all rights | Privacy Policy | Disclaimer